Maximize your tax benefit by donating publicly listed securities

Since gifts of securities come from assets rather than income, they receive a more favourable tax treatment. By making a donation of equities, bonds and/or mutual fund units to Outward Bound, your taxable capital gain is eliminated. On the other hand, if you choose to sell appreciated securities during your lifetime, or if these assets are liquidated through your estate, tax must be paid on 50 per cent of the capital gains on those securities. Donating securities to Outward Bound Canada provides an opportunity to eliminate a significant tax liability that would otherwise eventually have to be paid. It means a better tax break for you, and more young people becoming resilient through your generosity.

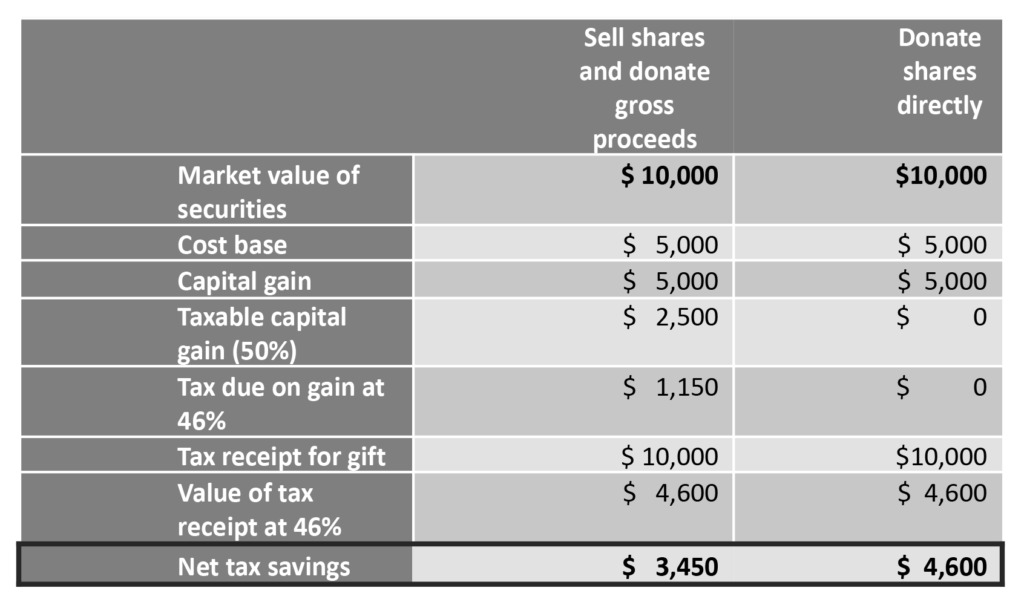

Example:

Andrea decides to support Outward Bound Canada with a gift of $10,000. When deciding whether she should sell her shares in a publicly listed corporation and then donate the cash proceeds or donate the shares directly, Andrea realizes that she would have a greater net tax benefit by donating the shares directly to Outward Bound. The chart below illustrates this example:

Example uses Ontario federal and provincial combined tax rate.

Advantages of Donating Securities

- Outward Bound Canada will issue you a charitable tax receipt for the fair market value of the gift of securities to be used for tax purposes. The fair market value will be the closing price of the securities on the date the securities are received in our account.

- If your donation exceeds the amount eligible for a tax credit in the year your gift is made, the excess credit may be carried forward up to five years.

- If you leave securities to Outward Bound Canada through your Will, your estate will receive the same tax benefits. Gifts made through your Will can be claimed up to 100 percent of your net annual income in the year of death and the year preceding.

Tax receipts for gifts of securities reflect the date the securities are received in our account. The deadline for receipt of 2021 gifts of securities is December 31, 2021.

Making a gift of publicly listed securities is easy!

Step 1:

Please complete all sections of the Securities Transfer Form.

For privacy reasons, your broker cannot disclose your name to us, so please complete the Donor Information section, including your daytime phone number with area code. Your advisor/broker will provide the CUSIP # which acts like a transaction number in case the transfer needs to be tracked.

Step 2:

Send a copy of the completed transfer form to Outward Bound Canada for processing.

This step is important because securities are transferred into our account anonymously, without your name listed. Notifying us will ensure you receive your official receipt for income tax purposes.

Outward Bound Canada

550 Bayview Avenue, Suite 402

Toronto, Ontario, M4W 3X8

Email: giving@outwardbound.ca

Phone: 1-888-688-9273

Fax: 1-866-328-9761

Step 3:

Send the completed transfer form to your broker or investment advisor.

Your broker or investment advisor is responsible for initiating the transfer.